Because of how we work when supporting our clients, we have a very unique “glimpse” into how over 5000 Executive Search companies and almost 20 000 decision makers react – the majority of which being located in Europe; and we collect and analyze how they respond; and we observe if and what kind of trends there are to leverage them into better career management & more effective job search methods.

Before there are trends, there are signals which we usually keep to ourselves. But these are not usual times, so we decided to share those market signals by the end of each week. If the country / context is important, we’ll add them. Otherwise, we’ll keep it general for confidentiality.

This is not a full version of this week’s report. View the complete presentation here:

We’ve continued reaching out to CEOs, HR Directors, investors, board members and candidates that we know personally, to take the temperature. Below you’ll find their shortened quotes in no particular order.

However, we’ll start with a KPI that gives a quite good feel of the overall trend on the job market:

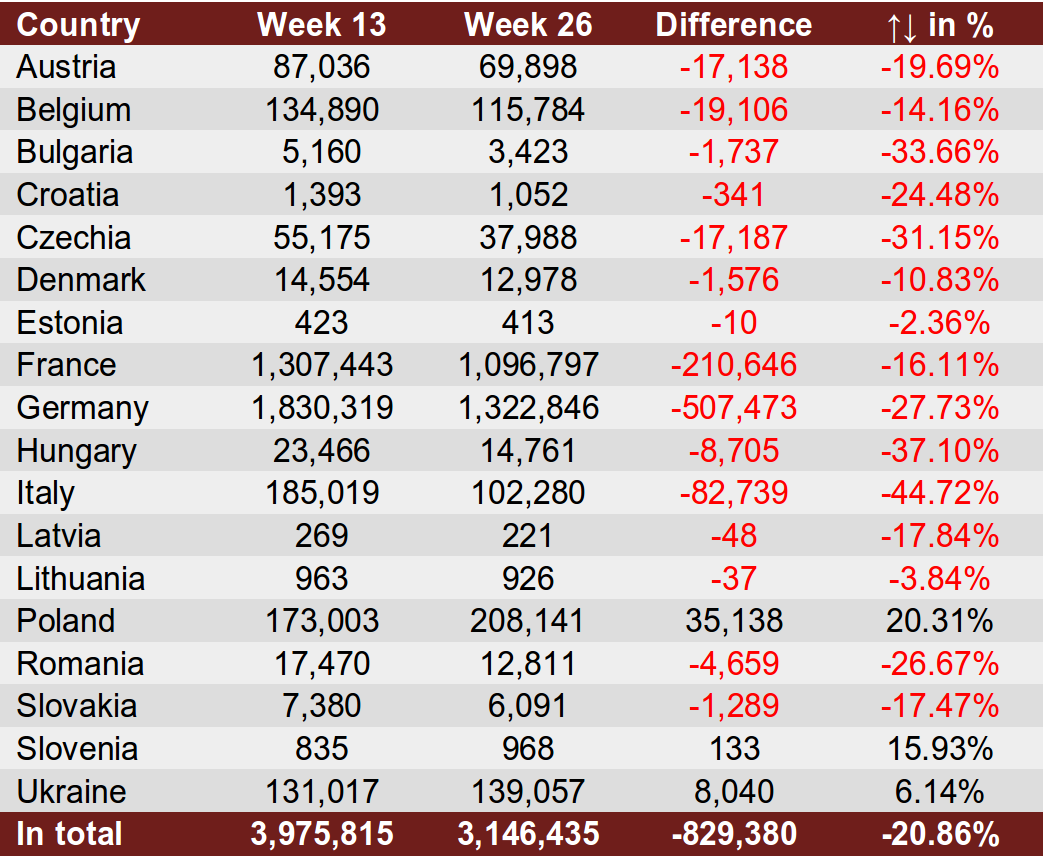

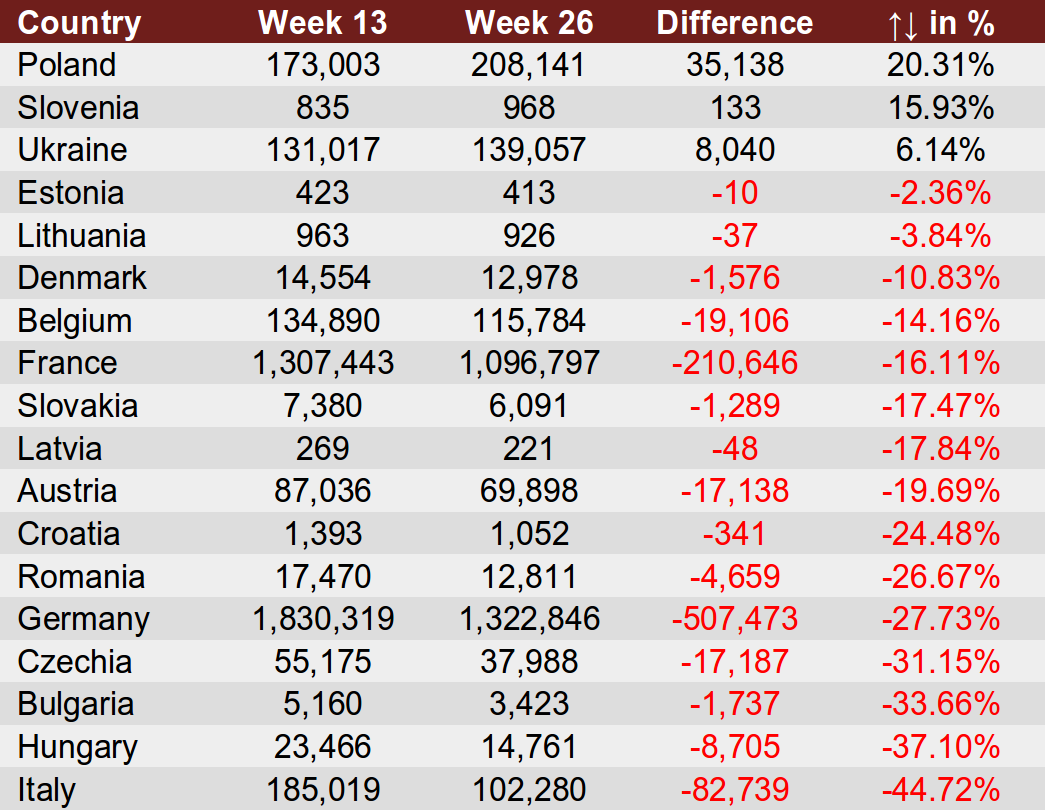

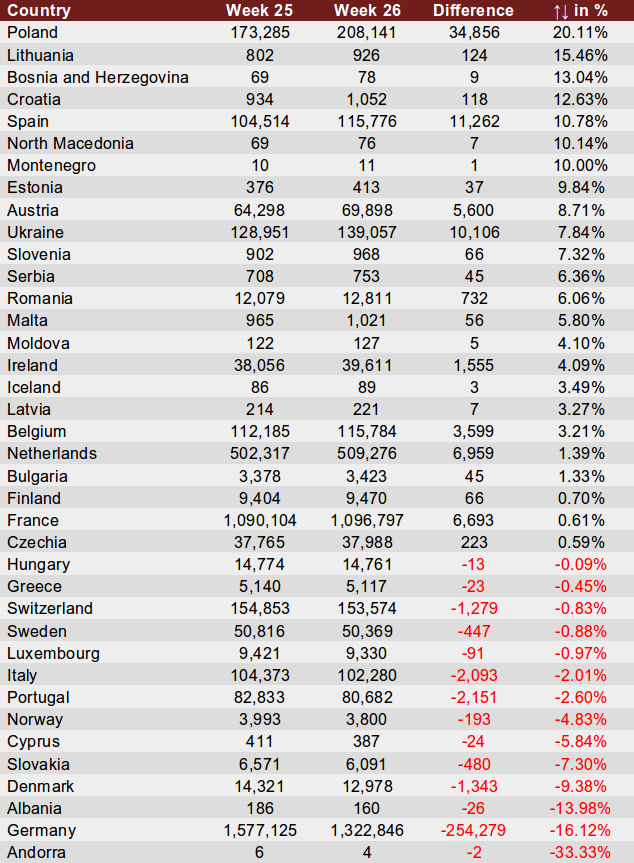

Number of published job ads on LinkedIn

Note: some job ads might have been taken off LinkedIn, not because the recruitment process was put on hold or canceled, but because they are costly, especially if you have dozens of them. A company might have wanted to simply cut costs and move to more cost effective alternatives. Some local job portals are offering substantial discounts.

| Initial list of 18 countries | Sorted |

|  |

| Extended list to 36 countries | Sorted |

|  |

Note: the numbers are collected at the beginning of each week, on Monday afternoon. In the full version of the report you can find separate data for regions such as: Visegrad, Baltics, Northern Europe, Southern Europe, Iberia, SEE, BENELUX, DACH, Western Europe and EU.

Worth mentioning

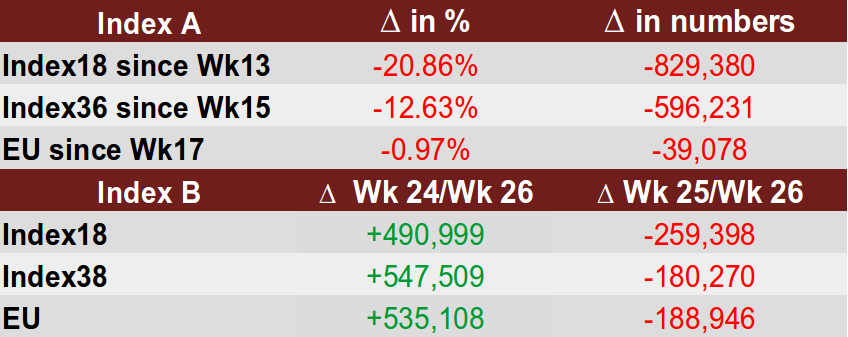

First an overview of the indices:

Index18: Only 3 countries published more job ads in Week 26 than in Week 15: Poland, Slovenia & Ukraine.

Index36: 44.45% of 36 countries saw a positive change this week, which is an increase of 5.56%, compared to Week 25 (38.89%). All that in just one week!

The European Union: The EU countries altogether saw a -4.70% decrease in the number of job ads – an 87.87% change compared to Week 25 (+4.13%).

Winners of the week: Poland was the winner of Week 26 with the biggest weekly increase in the number of published job ads (+20.11%). Thanks to that, the whole Visegrad region placed first (+15.09%). What’s more, Poland took second place in Week 13 & Week 26 comparison with a +35.95% change (outrun only by Slovenia’s significant rise of +72.55%).

Losers of the week: Germany noted the biggest decrease (-16.12%) this week, hence the last place of the whole DACH region (-13.92%). The other loser, Italy, between Week 15 & Week 26 experienced the biggest decline of the number of published job ads on LinkedIn: -39.89%! It resulted in Southern Europe experiencing the biggest loss out of all the regions (-27.90%).

Collected Quotes from CEOs and HR Directors:

The vast majority of executives are with market leaders in their respective industries. By default, the board members are members of local boards; if not, we’ll indicate the exception.

Travel platform: After an absolute rollercoaster of the last three months, it seems that we’ve weathered the storm. And: we are growing again!

Pharma research: Our industry is in observation and “wait and see” mode.

Executive Search: Across Europe, all senior roles in non-core business areas have been made redundant.

Retail: For our company, the pandemic turned the slow start of 2020 into a very serious situation. Our franchise has been heavily affected and we will not be able to survive making a loss.

Fund: Projects that we were considering are completely frozen now – the calculations would be very difficult to carry out. Some companies were affected negatively, but others are taking advantage of the situation thanks to their developed IT infrastructure.

E-commerce: The global workforce has been reduced by 40%.

Construction: We predict a slowdown in the next quarter.

IT: Our sales have dropped as the clients started to reduce their budgets – our support is no longer much-needed.

Healthcare: During an intense reorganization process in our company, apart from my day-to-day obligations, I was in charge of on-line recruitment. It’s been a very enriching experience from an employer’s point of view. I learned that finding engaged employees is a challenge.

Construction: The market has not been very friendly, but it’s not unstable either, although one can never be sure what’s coming. What worries me more is a global economic crisis and its consequences: unemployment and personal tragedies. But I can also see a slow but steady way out of this current apathetic situation.

Aviation: Our sector is very unstable and has suffered greatly.

Life Science: This crisis will push companies to try and find as many savings as possible and optimize their work. The IT industry should benefit quite a lot, as well as freelance.

E-commerce: We have benefited immensely from the current situation. E-commerce has become crucial in the retail sector, and a remedy for the lockdown and footfall’s decline.

And a candidate quote:

Supply Chain Operations Manager / Food & Drink: I was employed on a project-based contract and the project was cut short in February due to the pandemic. I left the company on friendly terms and have been looking for a similar position ever since. I’ve already sent out over 130 CVs with no result.

Our recommendations for experienced managers and executives:

- Keep engaging in recruitment processes. You don’t know if your job is indeed safe. Better to have a Plan B. It’s always better to be able to choose from a couple of options while you have a job rather than wake up with no job and have no options.

- If you have restructuring / change management / interim experience, prepare your project list or list of business cases.

- Prepare and practice interviewing online:

- from a technical perspective

- from a light & background perspective

- from a communication perspective

- Work on your communication skills: on paper (CV) and orally (strategic interviewing). Charisma alone will not get you shortlisted against hundreds of candidates; especially now that companies will look for low–risk candidates who can demonstrate very specific skill sets and leadership competencies.

If you want to discuss your professional situation confidentially or if you are considering hiring Career Angels for support, contact Bichl.Sandra@CareerAngels.eu who will personally match you with the most appropriate consultant. For efficiency, add your CV and availability for a Skype call.

If you want to contribute, email your signals to Sandra (everything will be kept confidential).

Market Signals published thus far:

Week 25

Week 24

Week 23

Week 22

Week 21

Week 20

Week 19

Week 18

Week 17

Week 16

Week 15

Week 14

Week 13