Because of how we work when supporting our clients, we have a very unique “glimpse” into how over 5000 Executive Search companies and almost 20 000 decision makers react – the majority of which being located in Europe; and we collect and analyze how they respond; and we observe if and what kind of trends there are to leverage them into better career management & more effective job search methods.

Before there are trends, there are signals which we usually keep to ourselves. But these are not usual times, so we decided to share these signals by the end of each week. If the country / context is important, we’ll add them. Otherwise, we’ll keep it general for confidentiality.

This is not a full version of this week’s report. View the complete presentation here:

We’ve continued reaching out to CEOs, HR Directors, investors, board members, that we know personally, to take the temperature. Below you’ll find their shortened quotes in no particular order.

However, we’ll start with a KPI that gives a quite good feel of the overall trend on the job market:

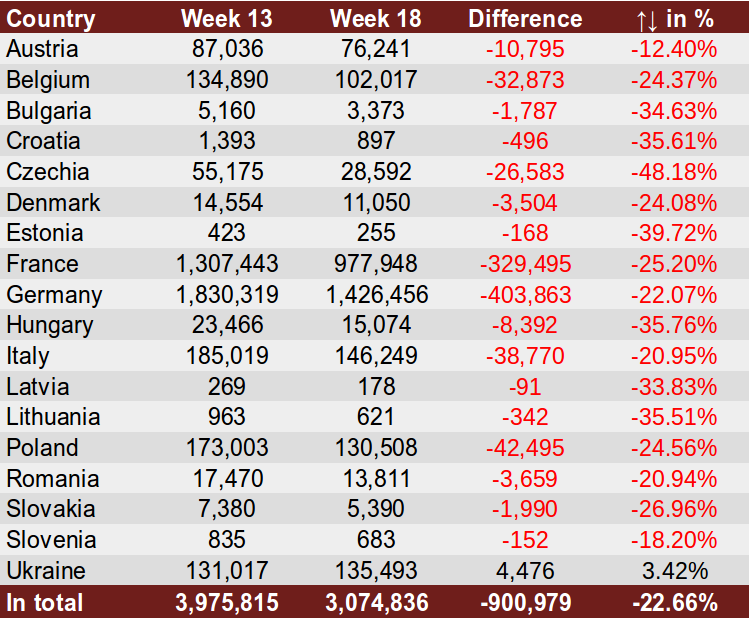

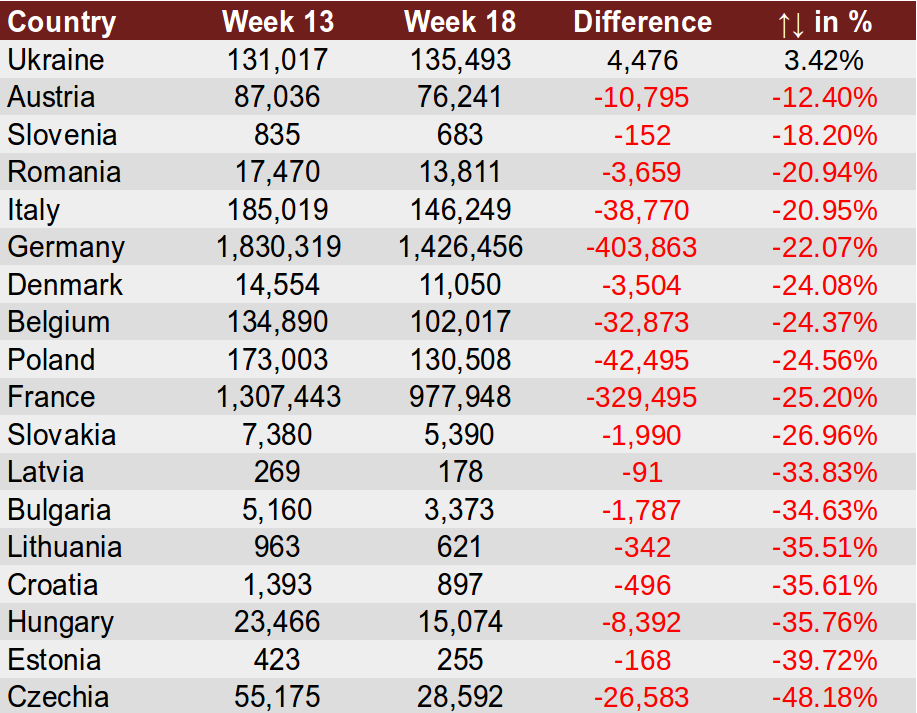

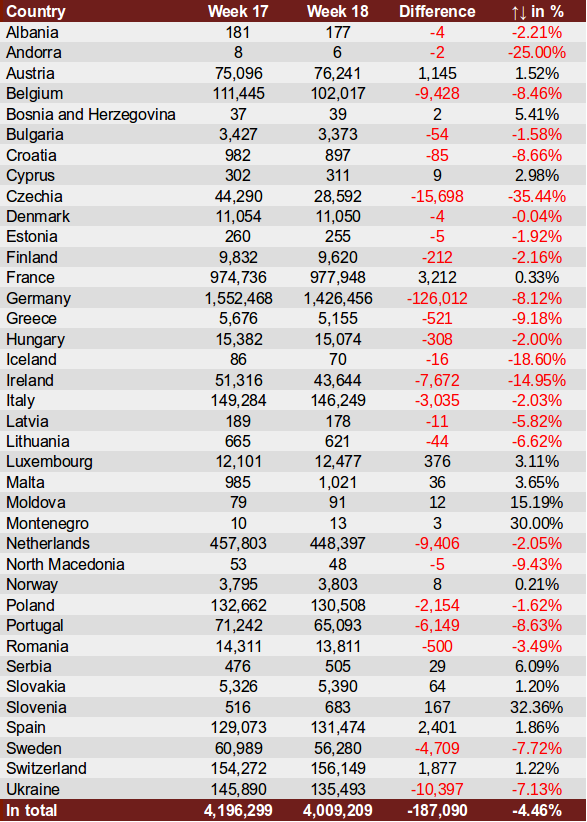

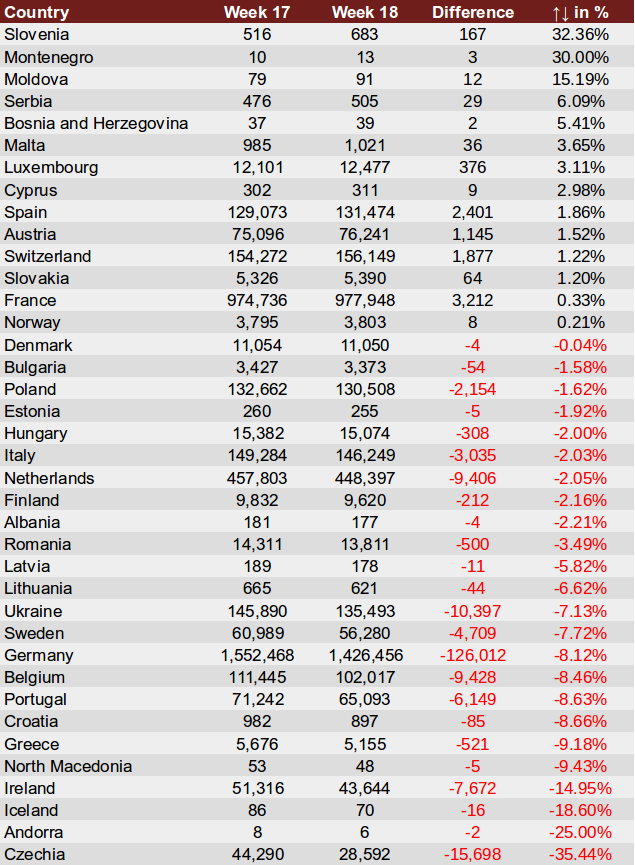

Number of published job ads on LinkedIn

Note: some job ads might have been taken off LinkedIn, not because the recruitment process was put on hold or canceled, but because they are costly, especially if you have dozens of them. A company might have wanted to simply cut costs and move to more cost effective alternatives. Some local job portals are offering substantial discounts.

| Initial list of 18 countries | Sorted |

|  |

| Extended list to 36 countries | Sorted |

|  |

Note: the numbers are collected each Monday afternoon. The regions are divided into: Visegrad, Baltics, Northern Europe, Southern Europe, Iberia, SEE, BENELUX, DACH, Western Europe and EU.

Collected Quotes from CEOs and HR Directors

The vast majority of executives are with market leaders in their respective industries. By default, the board members are members of local boards; if not, we’ll indicate the exception.

Illumination manufacturing: The times are unusual, but we haven’t got as hurt by COVID-19 as other branches.

Wholesale: Some cutbacks have been introduced, but no lay-offs. We’ve actually closed the first quarter at a better revenue and margin than in 2019, although the end of March was a little slower. Despite the good results, our situation depends on the whole corporation, so we don’t exclude any possible scenarios.

Logistics: Lay-offs are not an option at the moment, as we are profitable.

Marketing: Except for the obvious adaptations, we are doing fine. Finishing a project and starting a new, bigger one. The company structures are being maintained. We’re using all the tools: remote work, government aid and budget constraints.

Pharma: We are opening a new Service Center, so we’re actually hiring.

IT hardware: No lay-offs.

Beverages: It’s relatively OK. We have the best results in our category, so no mass lay-offs. A lot depends on May and June, though.

E-commerce leader: Our branch is highly benefiting, so our gains exceed the expectations. We’re hiring both assembly line employees and managers. Nevertheless, this is an exceptional case and a lot of companies are not as lucky.

IT: By the time the crisis hits us, it will have probably finished. We support banks in their big data software development. Our clients can afford our services and are obligated to have their solutions implemented on time. So it will take banks a minute to revise their budgets and activate the notice period.

FMCG: We’re not going to deliver all the savings, but honestly, we are a lot more stable than other companies on the market. No lay-offs planned, but we’re not hiring and promotions are put on hold.

Pharma: No lay-offs planned. The other half of the year will show where we stand.

IT: Our branch is not directly affected. We’ve implemented a freeze on wages, put promotions on hold and are trying to compensate for potential losses. We’ve switched to home office which was easy in our case. On the other hand, we are worried the crisis will hit us as well and that we’ll be forced to reduce costs. We’re not a big company with financial cushions that would allow us to survive for a long time.

Automotive: We’ve definitely noticed changes and are hoping to get back to normal soon.

IT: We’ve switched to home office and are not planning any lay-offs at the moment. The only exception: lay-offs that already had been planned.

Pharma: No lay-offs planned and we are actually hiring (especially for global purchasing).

Automotive: We’re living through interesting times that require wise decisions. It’s hard to predict how the situation will evolve.

Production: We produce in a non-food category for retail clients who stopped selling these products. So far, no lay-offs and the salaries have been cut by 20%. We are staying put for 3 months.

Tobacco: We’ve switched to remote work but, apart from that, everything is normal. We’ve recently hired a new manager and his on-boarding has been conducted fully remotely with success. We’ve shortlisted two candidates for another managerial position.

And the candidate side:

B2B Commercial Director, FMCG: Thanks to networking, I have found a job and will be introducing a new company to the market.

Our recommendations for experienced managers and executives:

- Keep engaging in recruitment processes. You don’t know if your job is indeed safe. Better to have a Plan B. It’s always better to be able to choose from a couple of options while you have a job rather than wake up with no job and have no options.

- If you have restructuring / change management / interim experience, prepare your project list or list of business cases.

- Prepare and practice interviewing online:

- from a technical perspective

- from a light & background perspective

- from a communication perspective

- Work on your communication skills: on paper (CV) and orally (strategic interviewing). Charisma alone will not get you shortlisted against hundreds of candidates; especially now that companies will look for low-risk candidates who can demonstrate very specific skill sets and leadership competencies.

If you want to discuss your professional situation confidentially or if you are considering hiring Career Angels for support, contact Bichl.Sandra@CareerAngels.eu who will personally match you with the most appropriate consultant. For efficiency, add your CV and availability for a Skype call.

If you want to contribute, email your signals to Sandra (everything will be kept confidential).

Market Signals published thus far:

Week 13

Week 14

Week 15

Week 16

Week 17

Week 18

Week 19

Week 20

Week 21

Week 22