How has COVID-19 changed the unemployment level? Do we have less unemployment than a year ago? Does it mean that the demand for candidates (the number of LinkedIn job ads) increased? Or is it the other way around? We took a closer look at the European unemployment rates and identified which countries noted an increase, a decrease, or a return to the unemployment level from before the COVID-19 pandemic after more than 1 year of its duration.

Let’s start by looking at both, the demand side (the number of LinkedIn job ads) and the supply side (the unemployment rates) of the job market:

Demand for candidates – the number of LinkedIn job ads

Between April 2020 & April 2021, out of 29 countries:

24 countries noted an increase in the number of LinkedIn job ads

5 countries noted a decrease in the number of LinkedIn job ads

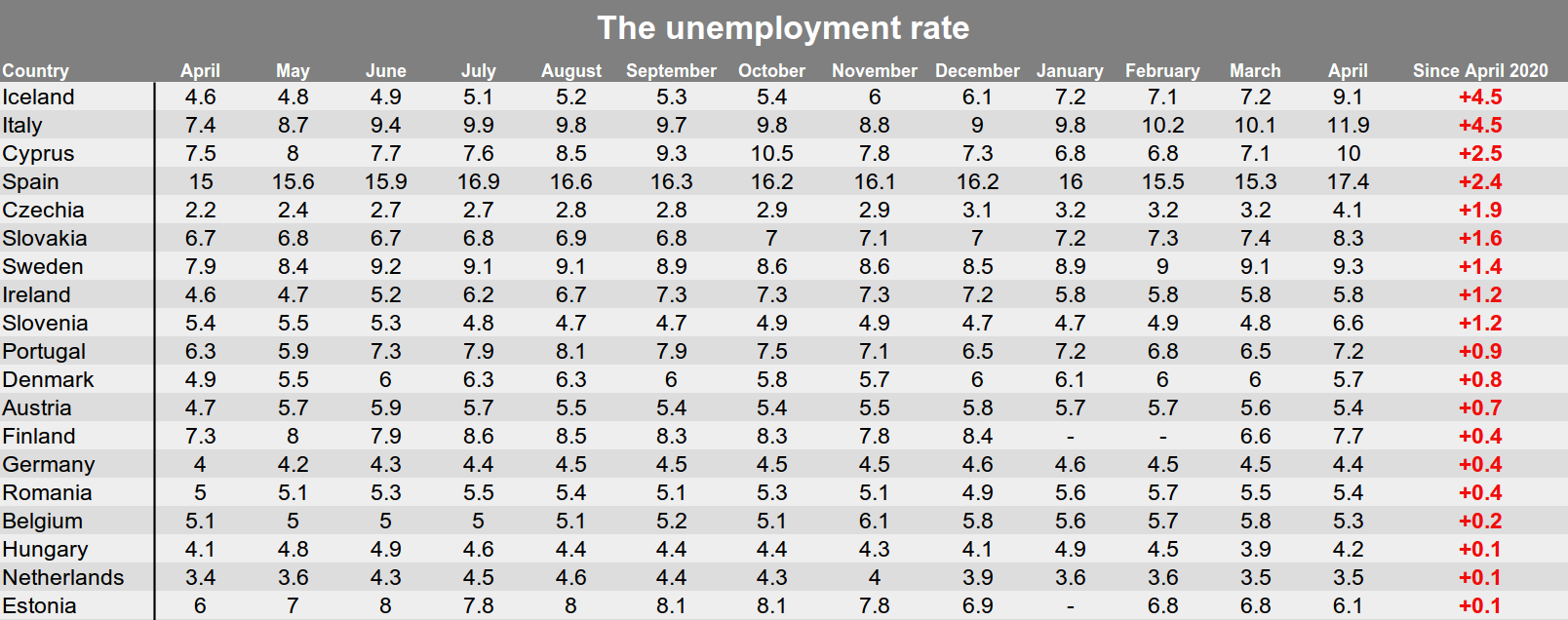

Supply of candidates – the unemployment rates

Between April 2020 & April 2021, out of 29 countries that have shared their most recent unemployment data:

Category 1: 19 countries noted an increase

Category 2: 2 countries returned to the same level

Category 3: 8 countries noted a decrease

Category 1: 65% → Increase in unemployment

The 19 countries that belong to this category noted an overall increase in unemployment. We observed the biggest rise in Iceland & Italy (+4.5 p.p. in both cases). The lowest increase was noted in Estonia, Hungary & the Netherlands (+0.1 p.p each).

Category 2: 6% → Return to the same level of unemployment

Among the 29 countries that provided their most recent unemployment data, 2 returned to the same unemployment level as the year before. In the case of Switzerland, we compared April 2020 and March 2021 due to a lack of full information.

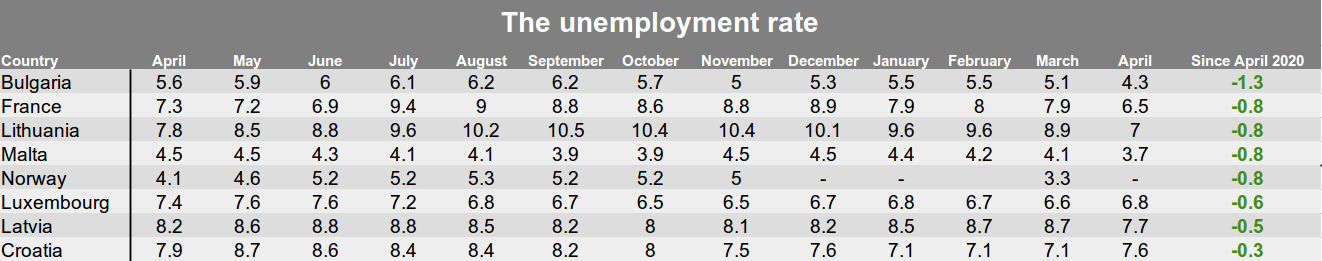

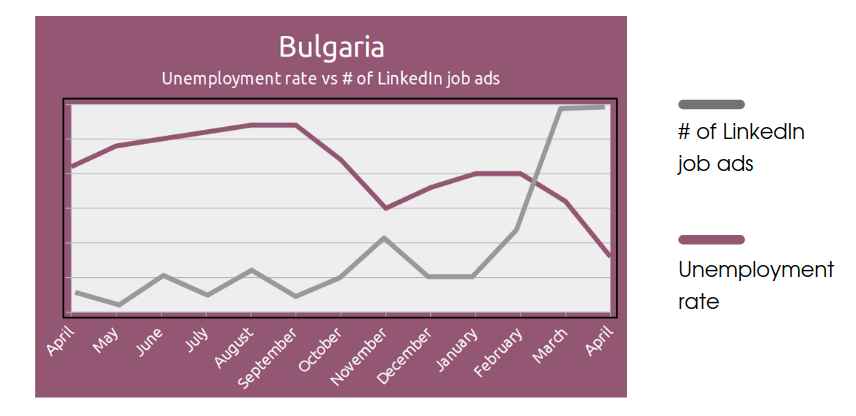

Category 3: 29% → Decrease in unemployment

Those 8 countries have noted a decrease in unemployment between April 2020 and April 2021. This means that the unemployment situation is better than a year ago. The biggest decrease happened in Bulgaria (-1.3 p.p ).

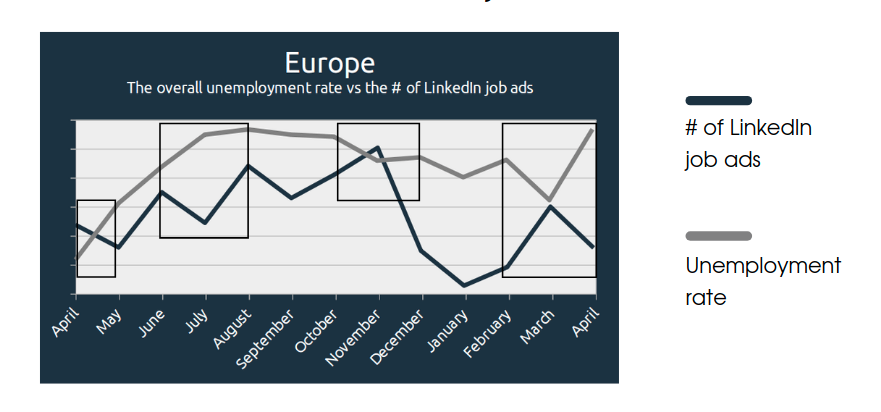

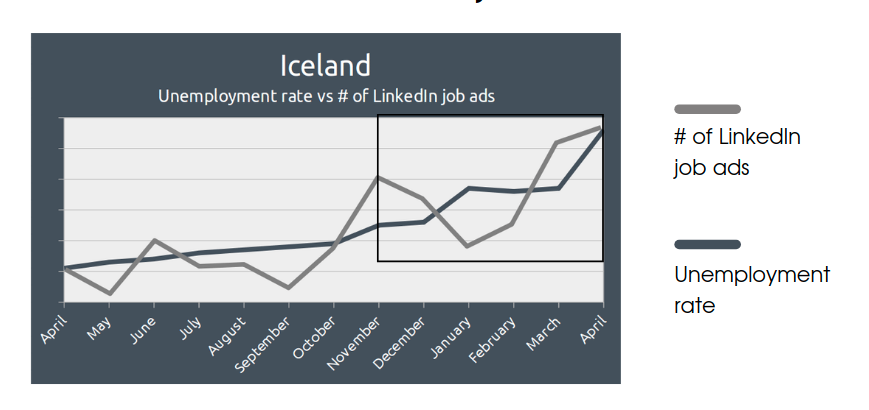

The “mirror effect”

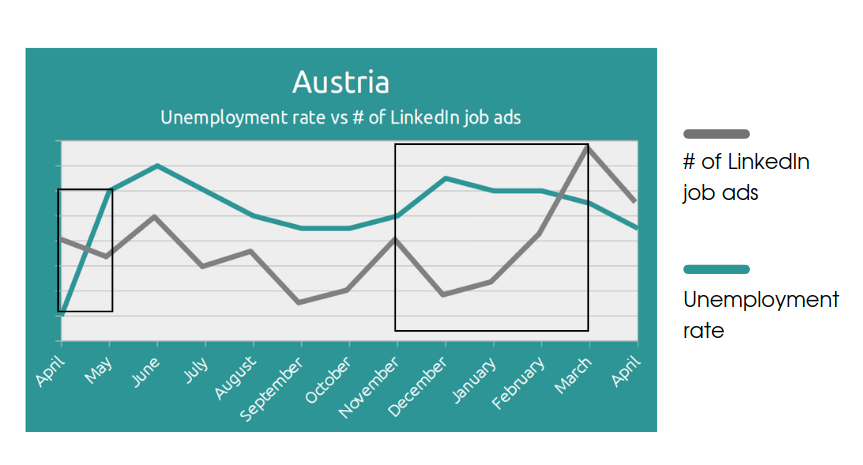

Most of the countries at some point of the last 12 months showed opposite tendencies in the number of LinkedIn job ads and in the unemployment rate. This means that when the former increased, the latter decreased and vice versa. Here a couple of visualized examples:

Europe altogether:

Iceland (the biggest increase in unemployment):

Austria:

Bulgaria (the biggest decrease in unemployment):

Is the job market picking up?

The European job market might be starting to pick up after a year of unusual conditions. Even though the situation still isn’t ideal, at the end of December 2020, all mentioned countries had seen an increase in unemployment. Now, it’s only half of Europe. Additionally, the level of LinkedIn job ads is also higher than a year ago in 83% of the countries that we analyzed. Those indicators may show an improvement, but to be fully sure about how stable the job market is we’ll have to wait a bit more, especially that several major corporations have announced further layoffs this year:

- Commerzbank will lay off 10,000 employees worldwide (CNN, May 11th, 2021)

- Deutsche Bank will lay off 18,000 employees worldwide (Deutsche Welle, February 4th, 2021)

- Mitsubishi will exit Europe by 2023 (Financial Times, February 23rd, 2021)

- Tesco & Aegon will exit the Polish market in 2021 (bankier.pl, March 30th, 2021)

- Carrefour is planning to exit Poland (bankier.pl, June 24th, 2021)

If you would like to know more about the COVID-19 influence on the European & global job market, email Bichl.Sandra@CareerAngels.eu and request our special reports.

So far, we have published:

- periodical reports summarizing the European job market situation amid the COVID-19 pandemic

- a report on the Nordics specially prepared for Exparang

- a special report on the top 20 economies in the world

- a special report on the Americas & Africa

For daily insights and weekly reports visit LinkedIn.com/Showcase/Market-Signals/ ← click Follow!

Find our weekly reports here.