Full Week 25 Market Signals report showing winners: Spain, Southern Europe and Losers: Czechia, Western Europe

Market Signals – where do they come from?

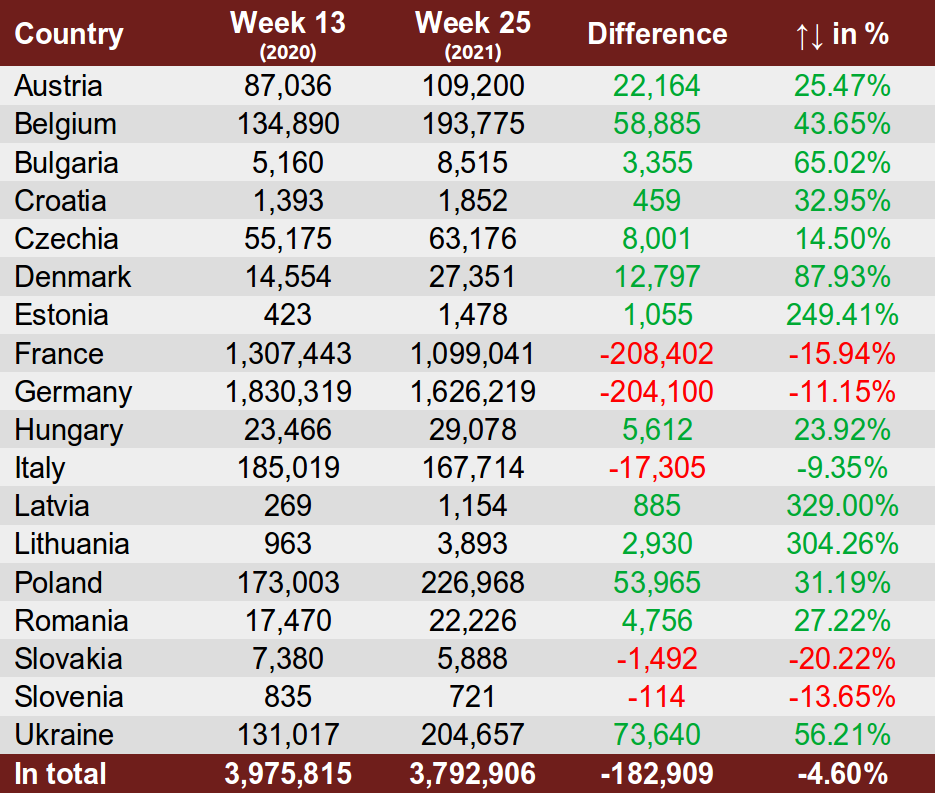

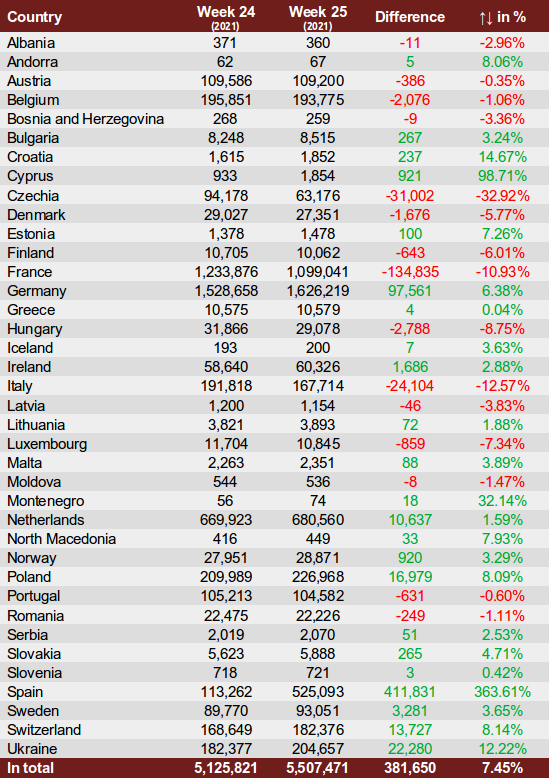

We started by monitoring the number of LinkedIn job ads in 18 European countries in Week 13 of 2020 (mid-March) – and extended our observations to ultimately 38 countries in Europe since Week 15. This allows us to measure a KPI that gives quite a good feel of the overall trend on the global job market.

Career Angels analyze the collected figures and complement the quantitative data with detailed and personal statements & insights of CEOs, HR Directors, investors, board members, candidates and headhunters that we know personally. We observe if and what kind of trends there are to leverage them into better candidate management & more effective job search methods.

These are not usual times, so we decided to share our market signals by the end of each week. If the country / context is important, we’ll add them. Otherwise, we’ll keep it general for confidentiality.

This is not a full version of this week’s report. View the complete presentation here:

We’ll start with a KPI that gives a quite good feel of the overall trend on the job market:

The number of LinkedIn job ads

What does it mean for employers and candidates? Knowing how the supply of and demand for candidates looks like in the markets you are active in, is an important source of data for both sides of the job markets:

- For employers (incl. recruiters & HR professionals): more demand for candidates (coupled often with less unemployment) means that salaries and/or benefit packages go up. The “post and pray” approach might not be enough to attract the talent you want and need.

- For active job seekers: the more demand, the less effort you need to put into your job search, phrasing it in a slightly simplified way. It doesn’t mean that finding a new role will happen overnight. But it’s a good indication of how much time the job search process might take. And if and how your salary negotiation position could improve (see point 1).

Note: some job ads might have been taken off LinkedIn, not because the recruitment process was put on hold or canceled, but because they are costly. Especially if you have dozens of them. A company might have wanted to simply cut costs and move to more cost-effective alternatives. Local job portals are often offering substantial discounts.

| Initial list of 18 countries | Sorted |

|  |

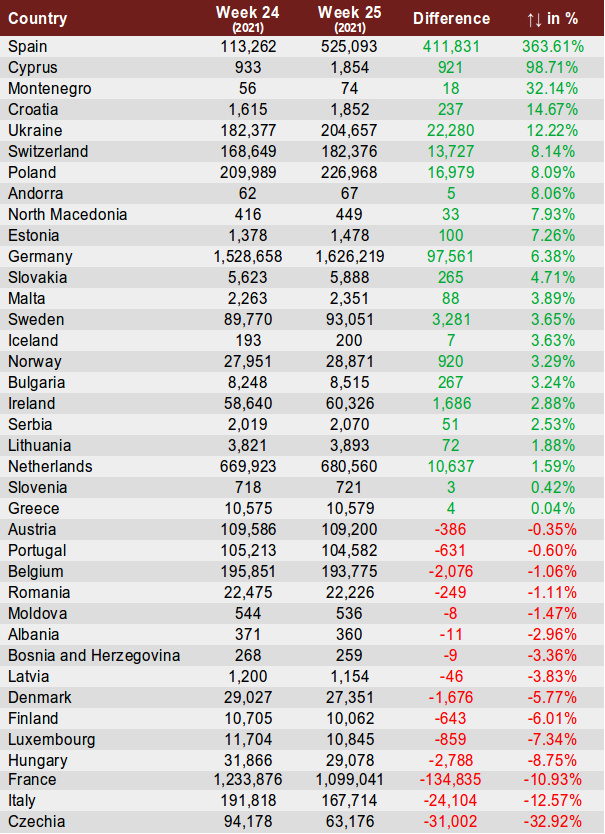

| Extended list to 38 countries | Sorted |

|  |

Note: the numbers are collected at the beginning of each week, on Monday afternoon. In the full version of this week’s report, you can find separate data for regions such as: Visegrad, Baltics, Northern Europe, Southern Europe, Iberia, SEE, BENELUX, DACH, Western Europe, and EU.

Worth mentioning

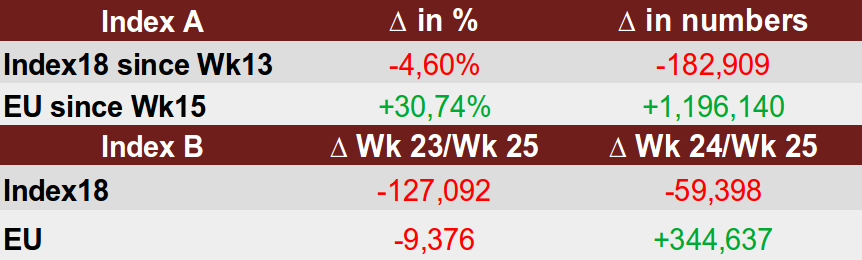

First, an overview of the indices:

Index18: This week, 13 countries published more job ads on LinkedIn than in Week 13 of 2020: Latvia, Lithuania, Estonia, Denmark, Bulgaria, Romania, Hungary, Croatia, Austria, Belgium, Ukraine, Czechia and Poland.

The European Union: In Week 25, the European Union noted a +30.74% increase: 1,196,140 more job ads were published than in the initial Week 17.

Winners of the week: When it comes to regions, the winning result belongs to Southern Europe: we observed an increase of +91.98% since last week. Country-wise, Spain is the winner with an increase of +363.61%.

Losers of the week: The lowest result out of all the regions this week was noted in Western Europe: a decrease of -0.41%. Worst country result: Czechia with a -32.92% decrease.

Collected Quotes from Executives

Retail: During and after COVID-19 we have actually noted an increase in sales and customer progression.

IT: During the peak of the pandemic we noted a spectacular 120% sales growth. Then, the company started to make changes in the product and people are leaving due to its lower quality.

Deloitte: The staff will be able to work wherever they want when COVID restrictions are eased and work from home guidance is scrapped.

Useful observations & tips for candidates from one of our contacts

Head of Talent Acquisition / International public organization

Before CV-19, sometimes we’d have only 20 applicants for a post. Now, there’s a massive increase. For some roles it’s double the amount of candidates – for HR roles, even more! A recent posting received 50 applicants within 12 hours! I can see that online interviews are more stressful for candidates because of all the technical challenges. Consequently, their performance is different. The overall candidate experience is also different – not worse, just different.

I still see two struggles for now and beyond CV-19: to formulate proper remote working policies, and to design appropriate digital onboarding processes.

About the future: everything will depend on the success of developing a vaccine. However, there are definitely elements that are here to stay: remote work if physical presence is not required (it currently saves me 5 hours per week, 20 hours per month on commuting – why would I voluntarily want to go back?) and online interviews!

Tips for candidates:

- Cover the basics: our ATS “enforces” as complete applications as possible. Having said that, it still surprises me that approximately 30% of the candidates still don’t get the absolute basics right!

- Don’t apply to everything. Constant rejection affects your motivation. Keep applying to the job ads where you see a fit and don’t give up!

If you want to discuss your professional situation confidentially or if you are considering hiring Career Angels for support, contact Bichl.Sandra@CareerAngels.eu who will personally match you with the most appropriate consultant. For efficiency, add your CV and availability for a Skype call.

Want to contribute? Email your signals to Sandra (everything will be kept confidential).

Follow our Market Signals page for daily content.

Market Signals published thus far:

In 2021:

In 2020: